Hey guys! We are back with the second edition of our Lessons Learned from the Self-Employed series. And if you missed the first post, be sure to check out my tips on Time Management and Working from Home. Tina Craig, founder and creator of Bag Snob, also weighed in and shared her insights too!

But for today’s topic, it’s all about financial responsibility. I know… I know…that doesn’t sound very glamorous, but it’s an important part of running any business. Budgeting for your household, getting insurance, or even just managing personal finances are all essential to managing financial responsibility. And honestly, finance is a topic we get asked about all the time.

Trust me, it doesn’t have to be scary or overwhelming! I’m giving you with some real takeaways and connecting you with some great resources, like Bestow. So don’t fret because I’m excited to share some of our Lessons Learned.

I often get asked about what happens behind the scenes of running a blog as a full-time business. Many of you have expressed interest in starting your own business one day, so I hope you can get a look behind the curtain and gain some insightful tips. Even if you aren’t self-employed or running your own business, the advice here can really be applied to any working woman.

Budgeting

There are several ways to keep a healthy and smart budget when running a small business. Here are a few things that we do to manage our business budget:

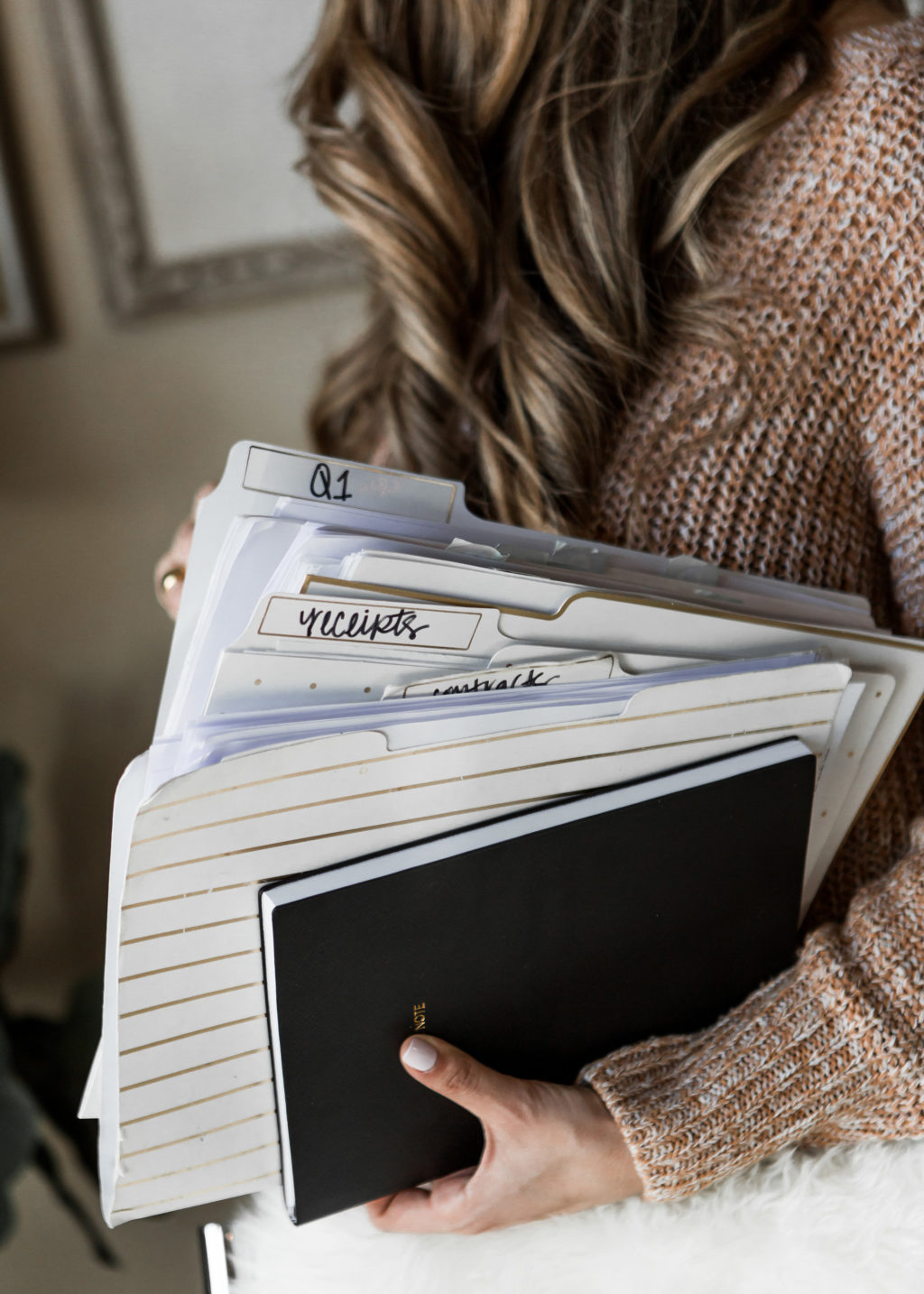

Record Expenses

This one might seem basic, but recording expenses is really essential to managing and maintaining a budget. If you don’t know what you’re spending, you can’t manage your costs.

Define Risks

Budgets get mismanaged when you don’t define and understand your financial risks. It’s important to ask yourself questions like: Am I prepared to take on industry trends or changes? Do I rely heavily on seasonal sales? What are potentially major upcoming expenses? Managing these risks and overestimating your expenses will safeguard you from future problems.

Pay Attention to your Revenue Cycle

Many businesses, including my own, have seasonal revenue cycles. Some months are slower than others and that’s sometimes just the nature of the industry. What’s important is that you conservatively anticipate the highs and the lows of this cycle. You can’t expect your best month to be every month. Although, I wish it was!

Insurance

A very important part of financially protecting yourself and your business is insurance. Insurance buys you the confidence to take on inevitable risks that are always apart of life and business. Without insurance, whether it be life, medical, or liability, it’s harder to confidently embark on your business’s journey.

Unfortunately, many small-business owners or even regularly employed individuals skip on coverage. Usually, people have some insurance, like medical or homeowner’s insurance. But many people skip on other important areas, like life insurance. You might say you don’t really understand it or that your husband already has some sort of coverage.

I’ll give you an example because I was definitely guilty of those excuses. Austin and I recently signed up for life insurance with Bestow, and my preconceptions about life insurance were quickly eliminated.

Life insurance is not something you normally think about. I always wrote off the idea because Austin had his own life insurance coverage through his job. But frankly, women deserve coverage too.

But frankly, women deserve coverage too.

I know so many women, both employed or running their household, that play such an essential role in the home. Today, women contribute to their household more than ever. Whether it’s financially or in other ways, women deserve the same confidence and coverage. But, a lot of women aren’t covered. And as a self-employed woman, I realized I needed to take steps to get covered. OK, but how?

Well, technology has made the life insurance coverage process simple. And Bestow does this really well. From their website, I answered a few basic questions and within less than 10 minutes, I had an email saying I was covered. There was no physical or doctor’s appointment. It’s also really affordable. Plans start at $2.50/mo. I was putting off this item on my to-do list, but the process actually ended up being ridiculously simple.

To keep the conversation going, we will be continuing our Lessons Learn series. Next time, we will be talking about when to take the leap and go full time with your business or blog. Be sure to stay tuned!

I hope these tips have been helpful for you guys. I want to hear your thoughts! What has been the hardest part about adjusting to running your own business? Let us know in the comments below or on social!

xx Ashley + Austin

LIVING ROOM PRODUCT DETAILS

Marble Wall Art | frames are from Ikea | Brooklyn Upholstered 94″ Sofa (I always get questions about our couch and I have to say – it has surpassed our expectations. It’s intimidating buying a white couch, but this has been very easy to clean and care for. We purchased this about 2 years ago and we love it!) | Leopard Pillows | Coasters | Coffee Table | similar Wooden Bowl (mine is old from Pottery Barn) | Allegra Tufted Pillow Cover 22×22″ | Mirrored Tray | Small Bosphorus Clear Glass Bowl c/o | Glamorous Homes Book

OFFICE DETAILS:

Swim Print | Baby Fern Print | Green Apple Print | Ahoy Wall Art | Melt Wall Art Vintage Deer Antlers| (these take a while to ship, but worth the wait!) | Hair Bun Art | The Humble Egg Print | Weathered Wall Art (I have the color “Slate”) | Tuscan Moroccan Rug | Desk | Chair

![]()

IMAGES BY MARY SUMMERS

This post is created in partnership in BESTOW. All opinions are my own.

Great post dear! x

http://www.evdaily.blogspot.com

This was such a great post! I definitely need to be smarter about my finances for my blog!

The Champagne Edit

Thank you! It’s not always the most enjoyable thing about owning your own business, but it’s something you have to consider. And hopefull these tips made it easier! xx AR

I love that you and Austin started this series. I’ve have a small business on Etsy and I know you have many bloggers that read your site, but I find this helpful for me as I learn how to expand and grow. Thank you for sharing! Ellie

Ah, thank you Ellie! We love to hear that. Best of luck to you and the launch of your new business! We hope you continue to find tips from this series. xx AR

Such a great post!

xx

Mademoiselle Coconath

http://mllecoconath.com

Thank you so much! xx AR

Loved this! As the wife of a self-employed husband, my favorite quote of his is “self employed is one day away from unemployed!” “Each day you start at zero!” “keep your overhead as small as possible and treat your customers as you would like to be treated”

As an aspiring blogger, I am very excited about this series!

How cute. Thank you for sharing. Sharing is caring. God bless.

I love this! I recently launched my own wedding stationary business, Grey Meets Gold Print Shop, in April and have been navigating the waters of owning a small business! This has been so great, I can’t wait to hear more on taking the leap! What is the best way that you store your receipts for business expenses?